Study with the several resources on Docsity

Earn points by helping other students or get them with a premium plan

Prepare for your exams

Study with the several resources on Docsity

Earn points to download

Earn points by helping other students or get them with a premium plan

Community

Ask the community for help and clear up your study doubts

Discover the best universities in your country according to Docsity users

Free resources

Download our free guides on studying techniques, anxiety management strategies, and thesis advice from Docsity tutors

Depreciation Expense - Lecture Notes | ABM 112, Study notes of Agricultural engineering

Material Type: Notes; Class: Records & Business Planning II; Subject: Agriculture Business Mgmt; University: Morgan Community College; Term: Unknown 1989;

Typology: Study notes

1 / 1

This page cannot be seen from the preview

Don't miss anything!

Related documents

Partial preview of the text

Download Depreciation Expense - Lecture Notes | ABM 112 and more Study notes Agricultural engineering in PDF only on Docsity!

II. Depreciation Expense When a business buys an asset it in effect buys a “fund of usefulness”. Day by day as the asset is used in the operations of the business, a portion of this usefulness is consumed or expired. In accounting, this expiration of an asset’s usefulness is called depreciation. All fixed assets except land lose their usefulness. Decreases in the usefulness of assets that are used in generating revenue are recorded as expenses. Depreciation is an expense and is deducted each year until the cost of the asset is expensed. The account debited is a depreciation expense account. The account credited is an accumulated depreciation account. Accumulated depreciation accounts are called contra accounts because they are deducted from the related asset accounts on the balance sheet. The use of a contra account allows the original cost to remain unchanged in the fixed asset account. Depreciation is called a non-cash expense since no actual dollars exchange hands. There are several methods of calculating depreciation with the most common being straight line.

Depreciation Expense example: a. An accountant figured the depreciation for a business as follows: equipment depreciation of $2500 and improvement depreciation of $1500.

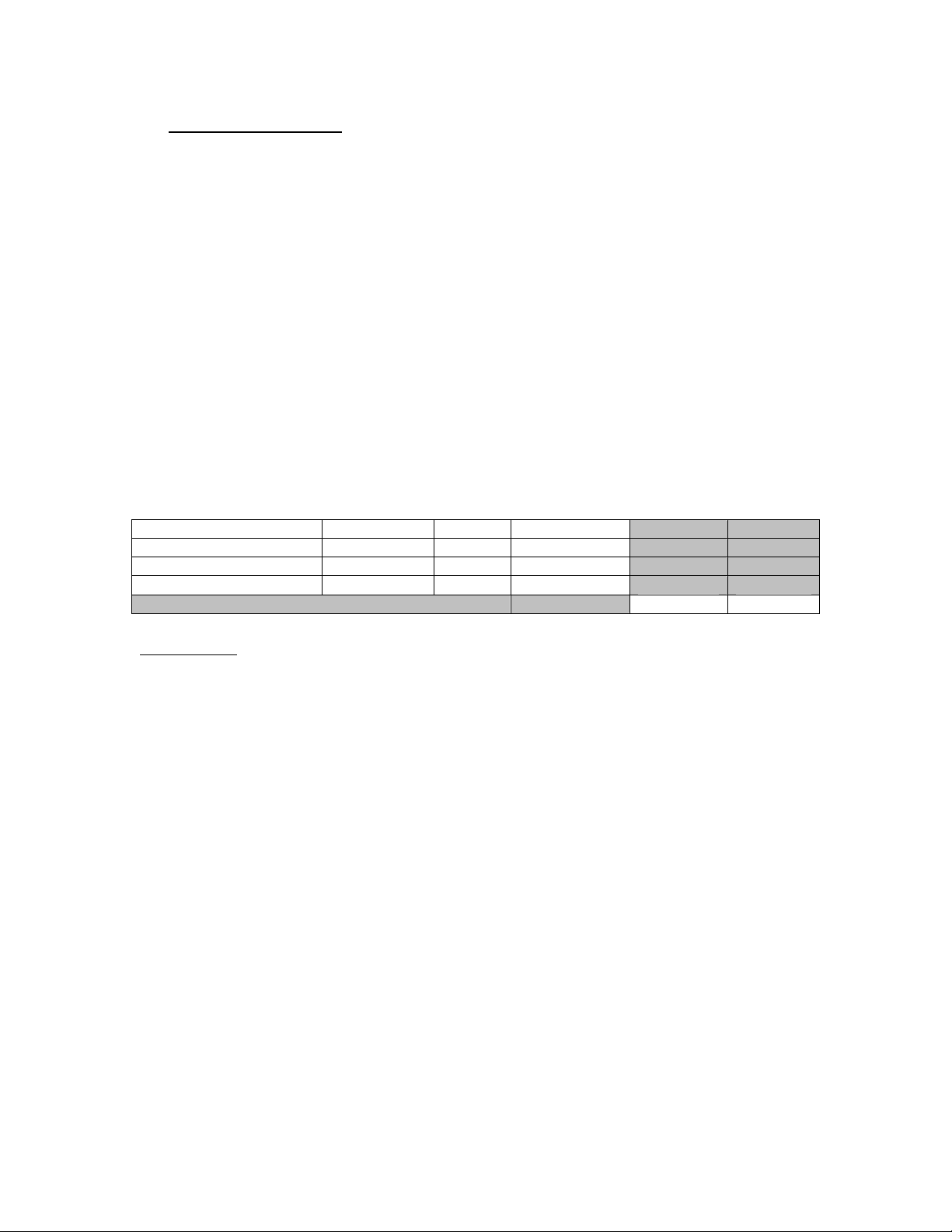

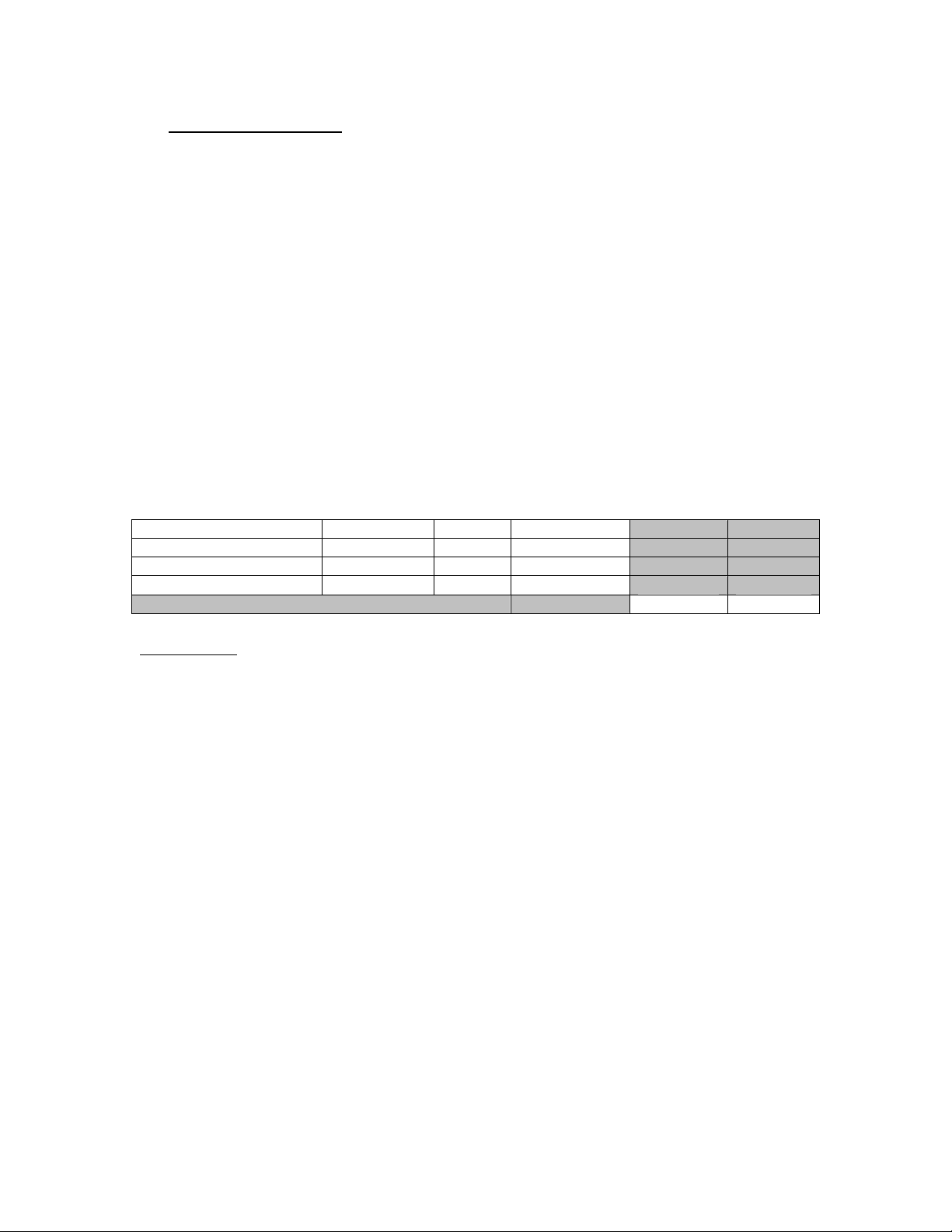

Account Name/Number Account type Increase Decrease Debit Credit Depreciation expense Expense 4,000 4, Accum Depreciation Equip Asset 2,500 2, Accum Depreciation Impr. Asset 1,00 1, Totals 4.000 4,

Explanation: Depreciation is an expense that affects the income statement by lowering the net income. This expense increases by $4,000 the total of the depreciation for the equipment and the improvements. It can be entered into more than one depreciation account depending on your preference. The dollar amounts in the accumulated depreciation account decrease each year as the life of the asset is used up. Depending on the set-up, there could be a separate depreciation account for each depreciable asset such as equipment and improvements.